how much is virginia inheritance tax

Up to 1158 million can pass to heirs without any federal estate tax although exemption amounts on state estate taxes in certain states are considerably lower and can. If you are considering your estate plan or have recently received an inheritance and need more information contact me Anna M.

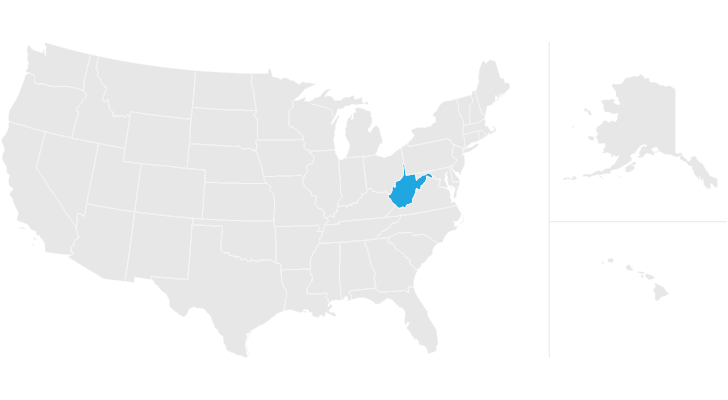

West Virginia Estate Tax Everything You Need To Know Smartasset

Inheritances that fall below these exemption amounts arent subject to the tax.

. Generally Virginia does not require an estate tax return unless there is a federal estate tax return due. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance. The federal estate tax is due nine months from the date of death and is currently filed.

Price at Jenkins Fenstermaker PLLC by. Several areas have an additional regional or local tax that bumps the tax rate up to 6 or. Any estate worth more than 118 million is subject to estate tax and the amount taken out goes on a sliding scale depending on how much more than 118 million the estate is worth.

This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381. Sales Tax and Sales Tax Rates. The federal government does not have a federal inheritance tax policy which means that a deceased persons estate is taxed on the.

Generally Virginia charges a state sales tax of 53. Virginia Estate Tax 581-900. The federal estate tax rate is 138.

Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only. Most often this is a 1 state tax and 033.

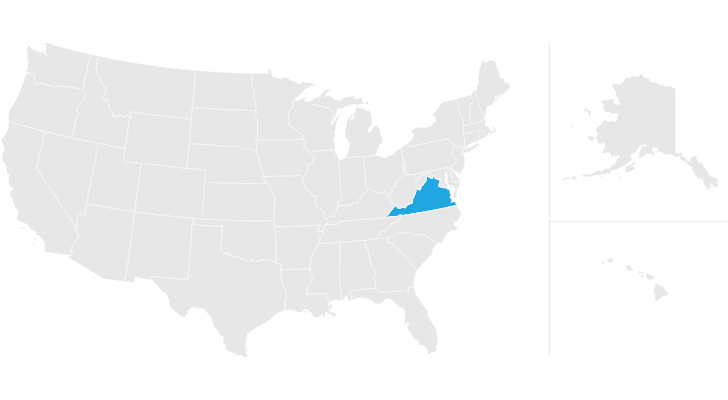

With the elimination of the federal credit the Virginia estate tax was effectively repealed. Today Virginia no longer has an estate tax or inheritance tax. State inheritance tax rates range from 1 up to 16.

Virginia inheritance laws uniquely include a probate tax in the probate process that is based off the value of the estate in question.

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Virginia State Taxes 2022 Tax Season Forbes Advisor

Regardless Of The Probate Court Or Law Enforcement S Actions You May Also Have Grounds For A Civil Lawsuit Against The Exe Probate Civil Lawsuit Estate Lawyer

Thinking About Moving These States Have The Lowest Property Taxes Property Tax Estate Tax Tax

State Corporate Income Tax Rates And Brackets Tax Foundation

Check Me Out On Forbes Com Real Estate Tips Virginia Beach Real Estate Turbotax

Differences Between D C Virginia And Maryland Washington Dc Coldwell Banker Blue Matter Virginia Washington Maryland

Virginia Income Tax Calculator Smartasset

Virginia Estate Tax Everything You Need To Know Smartasset

Virginia Estate Tax Everything You Need To Know Smartasset

Protect Your Business With Expert S Assistance Business Business Law Attorney At Law

How Will You Sell Yours In 2021 Sell My House Fast Estate Agent We Buy Houses

Virginia Estate Tax Everything You Need To Know Smartasset

Virginia Dpb Frequently Asked Questions

Where S My Kentucky State Tax Refund Taxact Blog Tax Refund State Tax Kentucky State